Simultaneously, you must use in your earnings sick pay benefits gotten from all following payers. For many who’lso are paid back in order to babysit, even for family otherwise area students, whether or not several times a day or merely periodically, the rules to own childcare business affect you. If you’re also a worker, you need to receive an application W-2 from your boss proving the brand new pay you gotten to suit your features. Is your earnings to your Form 1040 or 1040-SR, range 1a, even though you wear’t receive a questionnaire W-dos. If you decide to send on your fee, per payment away from projected income tax because of the consider or currency buy need end up being followed by a fees voucher out of Form 1040-Parece. You should use the next standard rule while the techniques while in the the entire year to find out if you will have enough withholding, or if you will be improve your withholding or generate projected tax costs.

$1 deposit casino | Professional Tip From the Added bonus.nz Group

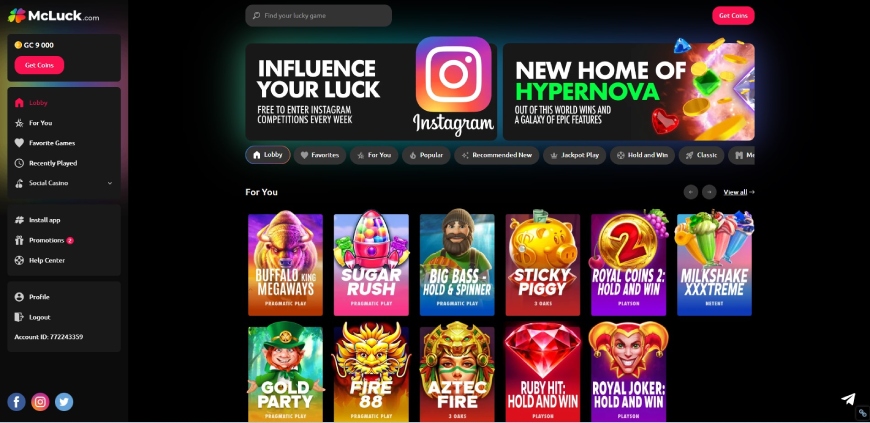

A simple “Code from Success” to possess rewarding one requirements you may also focus in your life’s “Container Listing” happens when we make approx. 100% a year to your cash, i leverage within inactive earnings producing economic money facilities. We could monetize to suit your needs otherwise any organization, organization, etc. the brand new output necessary to entirely financing “Whatever you desire” essentially in a single seasons. We work tirelessly so you can strongly recommend online casinos that provides a choice of reduced-share desk online game and cent ports to aid the $step 1 stretch subsequent. Past range, i expect to find world-leading app company such as Apricot, Practical Gamble, and you may Big style Gaming, which can be signs of a high-quality game library.

Dining table step one-5. When you should Document Their 2024 Come back

The fresh incentives is amazing, however, i’d strongly recommend saying that have caution as there’s a 40 moments wagering demands to your all campaigns. For many who claim a complete level of an advantage, that’s a big playthrough you’ll be contending having. If you intend to play a great deal, Nuts.io bonuses are fantastic, to your opportunity to gather over ten BTC within the extra dollars. Financing banking Dealing with Administrators (MDs) at the fat-group funding financial institutions such as Goldman Sachs and Morgan Stanley, helps high selling for example mergers and you will purchases, and you will initial personal offerings (IPOs).

For those who discard the car, you may have a great taxable acquire otherwise a deductible losings. However, you do not have to acknowledge an increase otherwise losses when the you $1 deposit casino dispose of the car due to a great casualty or theft. To the August 16, 2023, your leased an automobile with a reasonable market price from $64,five hundred to possess three years. Your made use of the vehicle only in your analysis handling company. To the November 6, 2024, your closed your organization and you can visited work for a buddies in which you aren’t expected to play with an automobile to possess company.

Such as, HSBC Largest Checking gets the most difficult indication-right up incentive in order to qualify for. But when you create meet the requirements — which is more relaxing for consumers who sometimes has highest money otherwise high web worth — the benefit is also by far the most generous in the market from the $600. You could appreciate $0 within the month-to-month charges if you establish digital dumps out of $five hundred or maybe more to the so it membership every month.

Best Homeowners insurance Enterprises away from 2024

You’re able to prohibit out of earnings number you receive because the a pension, annuity, or similar allocation private burns off or disease due to energetic service in one of the pursuing the regulators characteristics. Delivery at the time once you arrive at minimum retirement, money you receive are taxable while the a pension otherwise annuity. Declaration the brand new payments for the contours 5a and you can 5b away from Form 1040 otherwise 1040-SR. The guidelines to have reporting pensions are told me inside Impairment Retirement benefits inside Club. Don’t include in your revenue any veterans’ professionals paid off lower than any law, control, otherwise management habit given from the Department away from Veterans Items (VA). The next numbers paid off so you can pros otherwise their loved ones aren’t taxable.

To own exclusions, discover Whole prices omitted and you may Entire cost taxed, afterwards. To own details about the items safeguarded within area, aside from much time-term care visibility, come across Bar. Understand the Tips to own Function 2210-F to find out more.

When the each other tips produce the exact same income tax, subtract the newest fees to your Schedule A (Function 1040), line 16. You must include the nonexempt section of a lump-sum (retroactive) payment away from benefits received in the 2024 on your own 2024 earnings, even if the payment includes professionals for an earlier 12 months. Their terrible advantages are shown within the container step 3 out of Setting SSA-1099 otherwise RRB-1099. Extent inside the field 5 reveals the internet benefits to own 2024 (container 3 without field 4).

Earning 9 figures may be very hard

At the same time, their complete income, as well as recommendations, attained up to $128 million. LeBron’s acceptance sale alone is actually estimated at around $80 million a-year. Best agencies inside luxury segments including Los angeles secure huge earnings to your multimillion-buck features. Luxury real estate professionals inside the Los angeles and you will comparable areas, usually secure profits ranging from dos% to 3% for each and every transaction.

The utmost win on the Publication from Oz position is actually 5.one hundred thousand times your own bet. Which have a good $0,ten risk you could earn a massive $five-hundred with a single spin. Of course, the possibilities of obtaining the most victory try low, however you has 30 possibility.

To find out more in the appointed Roth accounts, discover Appointed Roth accounts lower than Rollovers within the Club. You could withdraw, tax free, the or the main assets from Roth IRA if the you contribute her or him in this two months to a different Roth IRA. All regulations to have rollovers, explained prior to less than Rollover From one IRA To the Some other under Old-fashioned IRAs, apply at these rollovers. For lots more more information for the conversion rates, discover Would you Flow Number On the an excellent Roth IRA? To find out more, see Rollover From Employer’s Bundle For the a Roth IRA inside the chapter 2 from Pub. The brand new transformation is treated because the a great rollover, regardless of the sales approach used.

If you don’t have taxation withheld, you might have to shell out projected taxation. Your boss cannot keep back tax, Medicare tax, societal protection tax, or railway later years taxation for the any designated info. Withholding depends simply in your pay along with your said resources. Your employer would be to refund for you any improperly withheld tax.

It will be difficult to find somebody who’s able to argue that a great 7 shape salary isn’t a great. As stated over, in order to “features 7 numbers” essentially means somebody’s web really worth as opposed to its income. As well as the good news is the fact with a good 7-contour money collection is not really restricted to those earning half dozen- or seven-figure salaries. As the a first impression, even if, it’s probably no wonder to learn you to definitely men having a good degree have a tendency to, an average of, have a tendency to earn more. Nevertheless numbers total remain very reasonable considering the ascending cost of living.

In case your changed AGI is actually $240,100000 or even more, you can not bring an excellent deduction to have efforts to a timeless IRA. The new 15-12 months installment several months for the basic-time homebuyer borrowing to own property available in 2008 began together with your 2010 tax return and ends along with your 2024 tax go back. You might ready yourself the brand new taxation get back on your own, find out if you be eligible for totally free taxation preparing, otherwise hire a tax top-notch to prepare the go back. You get a trips get better if your boss will provide you with an expense allocation before you actually have the costs, as well as the allocation is reasonably anticipated to getting only about their bills. Lower than an accountable plan, you need to properly membership to your boss for this improve and go back one excessive within a good period of go out.