What Is NEWT?

NEWT is the native utility token for Newton Protocol, developed by Magic Labs and supported by the Magic Newton Foundation. This protocol allows users to create secure, verifiable AI agents that execute on‑chain actions, such as portfolio rebalancing, cross-chain swaps, or routine maintenance, all wrapped in cryptographic proofs using zero‑knowledge (ZK) and Trusted Execution Environments (TEEs). These agents operate across chains (Base, Polygon AggLayer, etc.), marking a major shift in how automation works in DeFi binance.com+12medium.com+12medium.com+12.

Why it matters:

Traditional smart contracts cannot securely and verifiably handle AI-driven off‑chain tasks. NEWT bridges that gap—providing automation with both flexibility and assurance through ZK proofs and TEEs bitrue.com+5coinmarketcap.com+5blog.newt.foundation+5.

🧠 Team Members

The core team behind Newton Protocol includes Sean Li and Jaemin Jin, co-founders of Magic Labs—who have previously built wallet and UX tools used by over 50 million users and partnered with entities like Polygon, Helium, Forbes, and WalletConnect coinmarketcap.com+1binance.com+1.

The Magic Newton Foundation, managed by an independent board, drives decentralization and ecosystem growth facebook.com+15coinmarketcap.com+15binance.com+15.

💰 Funding Overview

Magic Labs has secured approximately $85–90 million in venture capital, led by heavyweight investors such as PayPal Ventures, DCG, Polygon, Placeholder, and well-known angels like Naval Ravikant and Balaji Srinivasan binance.com+1binance.com+1.

This substantial funding makes it one of the best-financed projects in the AI-onchain automation niche.

🧩 Tokenomics & Allocation

A total of 1 billion NEWT tokens were minted at genesis—there’s no inflation beyond this supply facebook.com+12coinmarketcap.com+12medium.com+12.

Planned distribution (whitepaper sources):

-

21 million “tracked” active tokens, with full 1B minted

-

0.75% (~157,500 NEWT) for airdrops and early user incentives facebook.com+14medium.com+14coinmarketcap.com+14

-

12% for community incentives over 4 years medium.com

-

18% allocated to team/advisors, vesting linearly over 4 years medium.com

-

20% to investors, with a 12-month cliff and linear unlock medium.com+1medium.com+1

-

10% treasury or protocol budgets

🔥 A 10% quarterly fee burn creates a deflationary mechanism reflecting usage medium.com+1medium.com+1.

🎯 Token Generation Event (TGE) & Airdrop

-

TGE Timing: Targeted for late Q3 2025, following key milestones like the Agent Marketplace Beta on AggLayer (June 2025) and zkPermission SDK release onesafe.io+8medium.com+8medium.com+8.

-

0.75% Allocation: Specifically for Kaito, Yapper, content creators, invitors, and AI-proxy activators binance.com+3binance.com+3binance.com+3.

-

Snapshot Rules:

-

Users earn Ethereal Credits by daily quests (dice rolls, social tasks, bridging, etc.)

-

Credits convert to Points at weekly snapshots

-

Higher Points → higher tier (Bronze → Diamond) → bigger airdrop share binance.com+5medium.com+5medium.com+5

-

-

KYC/Georestrictions:

-

Snapshot before KYC; claim post-KYC

-

Sanctioned regions blocked at claim time medium.comhelp.weex.com+2medium.com+2medium.com+2

-

🏦 Exchange & Perpetual Listings

-

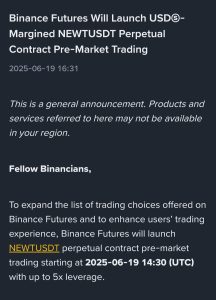

Perpetual Futures:

-

Binance recently listed NEWT/USDT perpetual contracts with up to 5× leverage, showing huge volatility (+99% intraday movement, 24h low-high between $0.15–$0.36, and ~5.24M NEWT traded) help.weex.com+2bitrue.com+2medium.com+2.

-

Gate.io also introduced NEWT perpetuals (1–10× leverage) on the same day binance.com+1help.weex.com+1.

-

-

Spot Trading:

-

As of early Q3 2025, no confirmed spot listings until the token completes TGE.

-

Likely to appear simultaneously on platforms like Binance, Gate.io, Coinbase, etc.

-

📈 NEWT Token Price Prediction

Any price forecast for NEWT is speculative, but here’s a structured view:

| Stage | Price Outlook |

|---|---|

| Pre-TGE | Virtual price via future trading; high volatility and low liquidity. |

| At TGE | Spot price may see initial pump from hype and listings. |

| Post-listing | Price depends on: |

-

Agent Marketplace usage

-

Fee burn vs usage

-

Broader market sentiment

-

Token unlocking schedule |

Upside scenario:

-

Strong agent deployment → real utility → Macroeconomic momentum.

-

Fee burns + high usage → deflationary pressure.

-

Institutional interest via perpetual demand.

Risks:

-

Low real-world usage → largely speculative trading.

-

Large unlocks (team/investor vesting) → supply pressure.

-

Market-wide pullbacks hurting low liquidity tokens.

🔥 Why NEWT Could Stand Out

-

Verifiable AI Automation: Unique tech stack not widely replicated medium.com+1medium.com+1medium.commedium.combitrue.com+1binance.com+1.

-

Strong Backing: High-profile investors and experienced team binance.com.

-

Tokenomics Built for Scarcity: Burning mechanisms and fixed supply enhance long-term alignment.

-

Ecosystem Launch Timeline: Pre-TGE readiness, Agent Marketplace roll-out, zkPermission SDK → heat up demand.

🧪 Key Metrics to Watch

-

Agent Marketplace Beta adoption on AggLayer/Base

-

zkPermission SDK audit and release

-

Weekly credit/points trends → user engagement

-

Spot trading volume & open interest post-listing

-

Token unlocking events (team/investor)

-

Protocol fees generated & burned per quarter

❓ Frequently Asked Questions (FAQ)

Q: What is NEWT’s total supply and circulating supply?

A: 1B minted; ~21M tracked for community & airdrop purposes medium.com+1medium.com+1coinmarketcap.com.

Q: How do users qualify for the airdrop?

A: Earn Ethereal Credits via daily quests, social tasks, agent interactions; convert to Points; tiered snapshot → bigger share .

Q: When and where is the TGE happening?

A: Late Q3 2025, post-audit and Agent Marketplace Beta. Key exchanges like Binance will list both spot and perpetuals .

Q: What can NEWT be used for?

A: Staking, agent deployment fees, fee rebates, governance, and decentralized validation medium.com.

Q: Is there inflation?

A: No. Total mint is 1B with no inflationary emissions post-genesis coinmarketcap.com+1medium.com+1.

Q: Are there locks or vesting schedules?

A: Yes. Team (4-year vest), advisors, investor cliff/unlock over time facebook.com+4medium.com+4medium.com+4.

Q: What exchanges support NEWT trading now?

A: Perpetuals on Binance & Gate.io; spot trading expected after TGE coinmarketcap.com+7x.com+7onesafe.io+7.

Q: Any investment risks to be aware of?

A: Low usage, market volatility, unlock-related dilution, technical/regulatory hurdles.